Identifying high-conviction stock opportunities in today’s fast-moving markets requires more than gut feel or basic chart reading. For UK traders navigating a landscape shaped by geopolitical uncertainty, shifting interest rate expectations, and sector rotation, the challenge is not simply finding potential winners—but filtering them with precision and confidence. That’s where a disciplined blend of technical and quantitative screening comes in. By combining proven analytical tools with a structured approach, traders can refine their equity selection process and build portfolios grounded in clarity rather than speculation.

Below, we explore how UK traders can use technical indicators, quantitative factors, and practical screening workflows to pinpoint high-conviction equity ideas. Whether you trade actively or maintain a more tactical approach, these techniques can help you sharpen your edge and strengthen decision-making.

Building Effective Technical Screens

Technical analysis provides immediate, data-driven insights into market sentiment and price momentum. Effective technical screens help traders filter large universes into manageable watchlists based on quantifiable conditions.

Momentum and Trend Filters

Momentum-based screens can help traders capture stocks that are already moving in a favourable direction. Key components include:

- Moving Average Alignment: A common high-conviction setup is when the 20-day, 50-day, and 200-day moving averages stack positively, signalling sustained upward momentum.

- Relative Strength Index (RSI): Filtering for stocks with RSI between 50–70 may highlight healthy, sustained strength without entering extreme overbought territory.

- MACD Crossovers: A bullish MACD line crossing above the signal line—supported by rising histogram bars—can indicate accelerating momentum.

Trend screens are especially valuable for UK traders monitoring sectors sensitive to macro themes such as financials, energy, and consumer staples. With the right filters, traders can quickly identify stocks that are not only trending but doing so with consistency.

Volatility-Based Screens

Volatility can expose potential breakouts and help traders calibrate risk.

- ATR (Average True Range): Filtering for rising ATR can highlight equities entering new volatility regimes—often preceding directional moves.

- Bollinger Bands: Stocks closing above their upper band on strong volume can signal early-stage breakouts, while mean-reversion traders may screen for touches near the lower band.

UK equities can be especially sensitive to macro data releases and currency movements. Using volatility screens helps traders assess which stocks may require wider stops or tighter risk controls.

Volume and Liquidity Filters

Strong volume trends often validate price movements.

- Volume Spike Screens: Identifying stocks with volume 1.5–2x higher than their 30-day average can reveal institutional interest.

- On-Balance Volume (OBV): Rising OBV with stable prices can indicate quiet accumulation—a potential early signal for a high-conviction setup.

For UK traders, liquidity is a practical concern. Filtering out low-volume stocks reduces slippage, tightens spreads, and improves trade execution quality.

Applying Quantitative Screens to Narrow the Field

Quantitative screening enhances the selection process by layering financial metrics, valuation ratios, and factor-based scoring.

Quality Metrics

Quality-focused traders often look for companies demonstrating consistent financial resilience.

Useful metrics include:

- Return on Equity (ROE): High ROE often reflects strong management efficiency.

- Stable Earnings Growth: Screening for positive, consistent EPS growth over multiple quarters.

- Low Debt-to-Equity Ratios: Ensuring that leverage does not compromise long-term sustainability.

These filters are particularly important in the UK market, where sector-specific cyclicality can mask performance trends without deeper analysis.

Valuation Screens

Valuation drives high-conviction ideas by identifying mispriced assets.

Useful filters include:

- Price-to-Earnings (P/E) Ratio: Screening for stocks trading below industry averages may uncover undervalued opportunities.

- Price-to-Book (P/B) Ratio: Helpful for financials and asset-heavy sectors.

- EV/EBITDA: An efficient cross-sector metric for identifying earnings efficiency relative to enterprise value.

Blending valuation with momentum—sometimes referred to as “value with a catalyst”—helps identify stocks that are not just cheap, but are beginning to trend upward.

Factor-Based Models

UK traders adopting a systematic approach often incorporate factor-based screens such as:

- Momentum: Price performance over 3-, 6-, or 12-month windows

- Size: Small- and mid-cap screens for growth potential

- Low Volatility: Focusing on equities with stable, defensive characteristics

- Quality: Fundamentals-driven risk filters

Factor models allow traders to build diversified baskets that target specific return premia with discipline and repeatability.

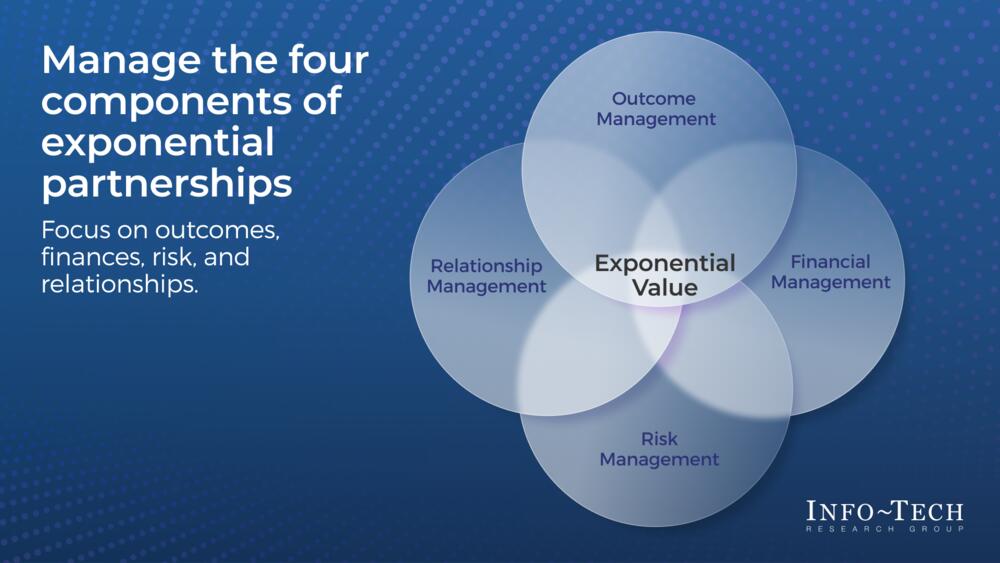

Integrating Technical and Quantitative Signals

High-conviction selection is strongest when both technical and quantitative signals align.

For example:

- A stock showing strong EPS growth (quant) and a bullish 50/200-day MA crossover (tech)

- An undervalued equity on an EV/EBITDA basis that also breaks above a long-term downtrend line

- A momentum leader with rising OBV and improving ROE

This intersection of signals increases confidence by showing not just directional intent, but structural support behind the price behaviour.

At this stage, traders often refine their watchlist further using educational resources that explain broader concepts such as stocks meaning, market drivers, and equity characteristics—particularly useful for newer traders sharpening their analytical frameworks.

Conclusion

High-conviction equity selection is not about predicting market extremes or chasing headlines—it’s about applying structure, discipline, and clarity to your decision-making process. By blending technical screens with quantitative models, UK traders can narrow their focus to stocks that not only look promising on the surface but also demonstrate underlying strength and compelling risk–reward profiles.

In an environment where quality information is abundant but time is limited, strategic screening empowers traders to move from reactive decisions to deliberate, well-supported choices. With a practical workflow and a commitment to consistency, high-conviction opportunities become easier to identify—and easier to act on with confidence.